Unlocking Efficiency: Key Features Of Treasury Management Systems

Are you ready to navigate the complex waters of modern finance with unwavering confidence? Treasury management solutions are no longer a luxury, but a necessity for businesses striving for financial agility and sustainable growth.

The financial landscape has dramatically transformed, and with it, the role of treasury management. Today, it transcends mere transactional functions; it stands as a strategic pillar, vital for financial stability and driving overall business success. It's a dynamic field, demanding constant adaptation and a proactive approach. The intricacies of managing cash flow, mitigating risks, and optimizing investments require a sophisticated approach. This is where treasury management solutions come into play. These solutions, often embodied in the form of a Treasury Management System (TMS), offer a comprehensive suite of tools designed to empower businesses to take control of their financial operations with precision and confidence.

A Treasury Management System (TMS) is, at its core, an integrated software solution designed to centralize and automate core treasury functions. Consider it the central nervous system for your financial operations, connecting various external systems such as banks and ERPs with internal finance workflows. This centralization is key for streamlined efficiency and better decision-making. It enables a holistic view of your financial health, enabling you to make more informed decisions, mitigate risks, and unlock new opportunities for growth.

- Iot Ssh Control Secure Remote Access Management Guide

- Remote Iot Web Ssh Raspberry Pi Access Your Device Anywhere

| Feature | Description |

|---|---|

| Cash Flow Management | Enables accurate forecasting of cash inflows and outflows, optimizing working capital and ensuring liquidity. |

| Liquidity Management | Ensures sufficient funds are available to meet short-term obligations, minimizing the risk of financial distress. |

| Payments Management | Centralizes payments, standardizes workflows, and provides real-time tracking of incoming and outgoing funds. |

| Financial Risk Management | Identifies and mitigates financial risks, such as interest rate and foreign exchange risks, through hedging strategies and other risk management tools. |

| Bank Account Administration | Offers a centralized view and control of all bank accounts, streamlining communication and reconciliation processes. |

| Investment Management | Supports debt and investment management, optimizing portfolios and tracking payments and maturity dates. |

| Forecasting | Provides accurate cash flow forecasting, enabling companies to anticipate financial needs and opportunities. |

| Reporting and Analytics | Generates real-time reports and provides insights into financial performance, facilitating better decision-making. |

| Compliance | Ensures regulatory compliance, mitigating the risk of penalties and legal issues. |

So, why should you consider integrating a TMS into your business operations? The benefits are multi-faceted and directly contribute to a more robust, efficient, and strategically sound financial approach.

One of the primary advantages is the enhanced ability to forecast cash flows with greater accuracy. This is a critical function, providing visibility into future financial needs and potential opportunities. Accurate forecasting allows businesses to proactively manage their working capital, ensuring sufficient liquidity while minimizing the risk of holding excessive cash balances.

A TMS centralizes payments, standardizes workflows, and provides real-time tracking of incoming and outgoing funds. This level of control streamlines operations, reduces errors, and minimizes the risk of fraud. The automation capabilities of a TMS significantly improve process efficiency, allowing treasury teams to focus on more strategic initiatives.

- Exploring Jonathan Byers Character Inside Stranger Things

- Nia Vardalos Ian Gomez Their 2008 Story Beyond

Furthermore, treasury management software is a powerful tool for risk management. It helps identify and mitigate financial risks such as interest rate and foreign exchange risks. By providing tools for hedging strategies and portfolio optimization, TMS solutions protect businesses from potential losses and safeguard financial stability.

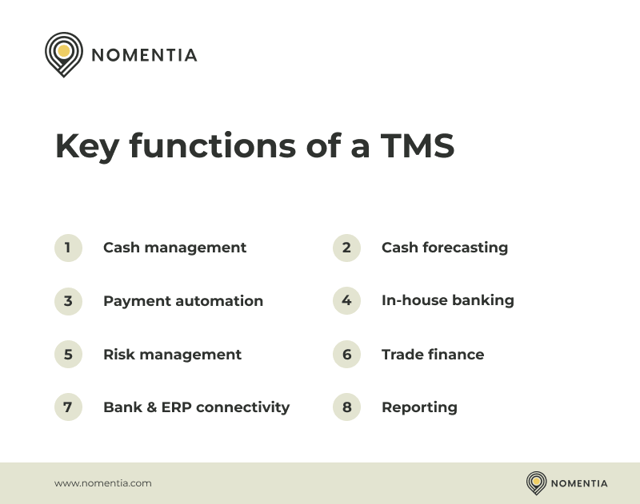

The key features of TMS solutions are diverse, but some functionalities are considered fairly universal across different platforms. These common features are integral to a TMS's ability to streamline treasury operations and provide a comprehensive view of an organization's financial position. These include:

The implementation of a treasury management system is a significant step toward optimizing treasury operations. However, the benefits of such a system extend far beyond mere efficiency gains. The strategic advantages it offers can reshape how a business manages its finances, driving profitability and promoting sustainable growth.

The process of selecting a TMS requires careful consideration. Choosing a system that aligns with the specific needs and objectives of your organization is crucial. Evaluating core features, such as cash flow forecasting, payment management, and risk management capabilities, ensures that the selected solution will effectively address your treasury challenges.

Moreover, treasury management solutions offer robust reporting and analytics capabilities. Real-time insights into financial performance enable better decision-making, allowing businesses to proactively respond to market changes and emerging opportunities. These insights are invaluable for strategic planning and resource allocation.

The shift toward advanced treasury management is a direct response to the evolving complexities of the global financial landscape. The increasing volatility of currency markets, rising interest rates, and stringent regulatory requirements demand sophisticated tools and strategies. TMS solutions are specifically designed to meet these challenges.

The role of treasury management has undergone a significant evolution. It is no longer just about transactional functions; treasury now serves as a strategic pillar that supports broader business goals. By providing insights into financial performance, risk management, and strategic planning, treasury management solutions contribute to overall financial health and organizational success.

The efficiency of modern treasury management also extends to compliance. A robust TMS can help ensure that an organization meets all relevant regulatory requirements, minimizing the risk of penalties and legal issues. Regulatory compliance is a critical aspect of financial management, and a TMS can provide the tools and processes necessary to maintain compliance.

A well-implemented TMS integrates seamlessly with external systems like banks and ERPs. This integration eliminates manual data entry and reduces the likelihood of errors, saving time and resources. Streamlined communication with banks and other financial institutions further simplifies treasury processes.

For many large enterprises, a TMS serves as the central hub of their treasury operations, connecting external systems like banks and ERPs with internal finance workflows. This centralization ensures data integrity, enhances reporting capabilities, and provides a unified view of financial information.

Inaccuracy in treasury management processes can lead to sizeable consequences. From missed investment opportunities to failure to comply with regulations, inefficiencies in treasury functions can negatively impact profitability and organizational reputation. A TMS is therefore a risk mitigator, as well as an efficiency booster.

In conclusion, embracing the right treasury management solutions is essential for businesses aiming to thrive in the modern financial environment. From streamlining operations to mitigating risks and providing data-driven insights, these solutions empower organizations to achieve financial excellence and strategic growth.

Detail Author:

- Name : Ubaldo Crooks

- Username : carleton79

- Email : dimitri.stoltenberg@gmail.com

- Birthdate : 1981-12-12

- Address : 144 Jamison Mountain Port Santostown, DE 75660-0893

- Phone : (912) 433-4534

- Company : Grant, Mayert and Swaniawski

- Job : Automatic Teller Machine Servicer

- Bio : Delectus nisi eos sit quas. Consequuntur accusamus vel molestiae dicta officiis. Ipsum qui est molestias eligendi nihil dicta.

Socials

facebook:

- url : https://facebook.com/davonte_xx

- username : davonte_xx

- bio : At ut aut enim doloribus. Quas voluptatem velit explicabo doloribus.

- followers : 6126

- following : 2440

linkedin:

- url : https://linkedin.com/in/davonte4198

- username : davonte4198

- bio : Quis ut numquam ex et ut asperiores amet.

- followers : 4040

- following : 998

tiktok:

- url : https://tiktok.com/@dgoldner

- username : dgoldner

- bio : Quo odio dolore aut deleniti laudantium laborum minus.

- followers : 511

- following : 453