Treasury Management: Key Features & Benefits You Need To Know

Is your company's financial future as secure as it could be? Treasury management, often overlooked, is the bedrock upon which financial stability and growth are built, acting as the critical engine that propels your business forward, or it could hold your company back.

Navigating the complex world of corporate finance requires more than just reacting to market changes; it demands a proactive and strategic approach. This is where treasury management comes into play, providing the tools and insights needed to optimize financial resources, mitigate risks, and foster sustainable growth. Treasury management, at its core, is the strategic management of an organizations financial resources to optimize its liquidity position, minimize risk, and maximize overall financial performance. Effective treasury management is not merely a back-office function; it's a critical driver of business success, contributing to both financial stability and value creation.

Let's delve deeper into the core principles and practical applications of treasury management, providing a roadmap for businesses seeking to fortify their financial strategies.

- Access Your Iot Devices Remotely Behind Router Solutions Amp Tips

- Avoid 5movierulz Watch Kannada Movies 2024 Safely Legally

At the heart of any successful financial strategy lies robust cash flow management. This is the process of overseeing daily cash flow to maintain sufficient access to working capital. This means tracking incoming and outgoing funds in real-time, ensuring that a company has the financial resources to meet its obligations. Should the risk of cash depletion arise, comprehensive cash management can make it easier to balance cash flow and replenish funds, preventing potential financial disruptions.

Effective cash flow management enables companies to forecast cash flows accurately and optimize working capital. This allows businesses to anticipate potential shortfalls and proactively plan for them, such as through securing lines of credit or adjusting payment schedules. In today's dynamic financial environment, the ability to accurately forecast and manage cash flow is not merely a best practice; it's a necessity.

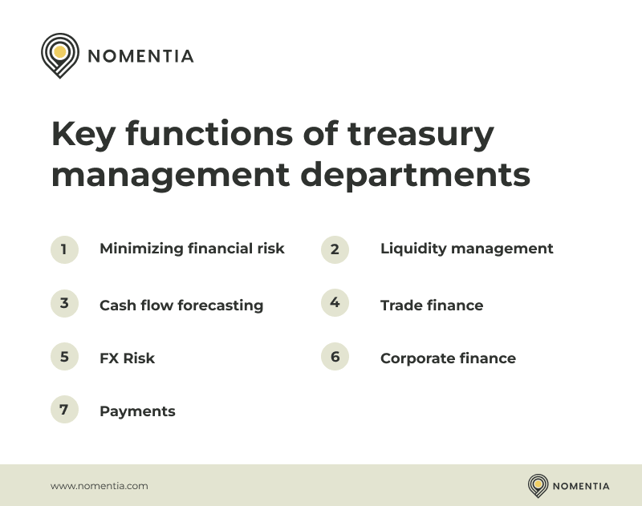

The three fundamental principles of treasury management are: liquidity management, risk management, and optimizing funding strategies. Liquidity management ensures adequate cash flow to meet financial obligations. This involves maintaining the right balance of cash and liquid assets to cover short-term liabilities. Risk management, which involves identifying and mitigating financial risks, protects the company from potential losses due to market volatility, interest rate fluctuations, or currency exchange rate movements. Optimizing funding strategies maintain financial stability and support organizational growth objectives. This involves finding the most cost-effective ways to finance operations and investments.

- Movierulz Proxies Risks Legal Alternatives What You Need To Know

- Tan Chuan Jins Marital Status The Truth Divorce Explained

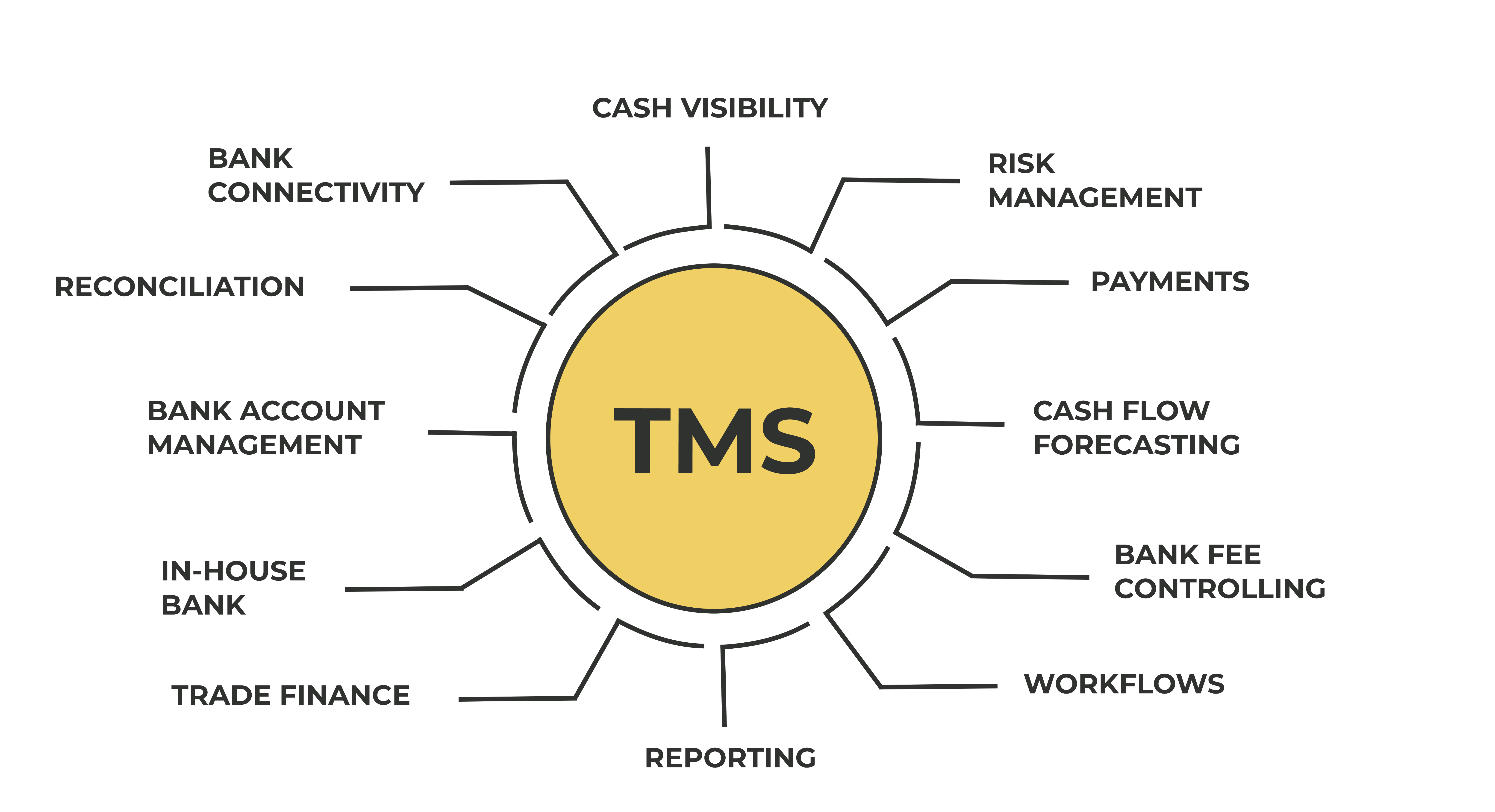

A treasury management system (TMS) is a solution that helps businesses manage cash flow, liquidity, payments, and financial risk. A TMS is an integrated software solution designed to centralize and automate core treasury functions, including cash management, forecasting, financial risk management, payments, bank account administration, and regulatory compliance. These systems offer powerful tools to manage cash flow, liquidity, risk, and payments efficiently. Treasury management systems offer integrated tools to optimize working capital, manage cash pools, and prevent cash. While different TMS platforms offer unique spins on functionality, certain features are fairly universal. These include tracking incoming and outgoing funds in real-time, centralizing payments, and standardizing workflows.

The importance of a TMS cannot be overstated in todays complex financial landscape. With so many options available, finding the right system for your needs requires careful consideration. When selecting a treasury management system, its essential to understand the core features that will benefit your financial operations. Each feature is designed to address specific needs within treasury management, enhancing overall efficiency and effectiveness. A strong TMS includes core features such as robust cash flow forecasting, automated payment processing, and comprehensive risk management capabilities.

Risk management is a vital aspect of treasury operations, particularly in todays volatile financial markets. Effective treasury management software should include features that help identify, assess, and mitigate various types of financial risks such as interest rate risk, currency risk, or liquidity risk. Managing these risks proactively is crucial for maintaining financial stability and protecting a company's bottom line.

The advantages of using treasury management software are substantial. Adopting a software solution to power your treasury management requires careful planning and investment, but the potential returns in efficiency, insight, and risk mitigation can be substantial. Treasury management software offers benefits such as improved cash visibility, reduced operational costs, enhanced risk management, and better decision-making capabilities. By implementing these solutions, companies can achieve greater control over their financial resources and drive better financial outcomes.

Keybank offers payments solutions for healthcare, real estate, and the public sector. Key) announced today its launch of keynavigator, a comprehensive digital treasury management platform that enables businesses to manage all their commercial banking services, accounts, and activities in one place. The enhanced platform streamlines daily cash management activities and integrates with clients' business systems, allowing treasury professionals to make financial decisions more efficiently and with greater insight.

The biggest benefits of using treasury and risk management in SAP S/4HANA include streamlined processes, real-time visibility, and improved decision-making. SAP S/4HANA offers innovative apps and services that enhance the value of treasury management systems. Integrated treasury solutions can enhance your organizations payment strategy. With Keybanks efficient, customizable paper and electronic payment services, you get the control you need to successfully manage all payment functions, from the straightforward to the complex.

Here's a detailed table summarizing the critical components of treasury management:

| Key Component | Description | Importance |

|---|---|---|

| Cash Flow Management | Overseeing daily cash flow; forecasting and managing cash inflows and outflows. | Ensures sufficient access to working capital; supports day-to-day operations. |

| Liquidity Management | Maintaining sufficient cash and liquid assets to meet short-term obligations. | Guarantees financial stability; prevents liquidity crises. |

| Risk Management | Identifying, assessing, and mitigating financial risks (e.g., interest rate, currency). | Protects against financial losses; enhances financial stability. |

| Working Capital Optimization | Optimizing the level of current assets and liabilities to maximize profitability. | Improves operational efficiency; enhances overall financial performance. |

| Funding Strategies | Developing and executing cost-effective funding plans. | Supports business growth; maintains financial stability. |

| Investment Management | Managing surplus cash in short-term, low-risk investments. | Generates additional revenue; preserves capital. |

| Payment Management | Efficiently managing and processing payments. | Streamlines financial processes; reduces operational costs. |

| Bank Relationship Management | Maintaining effective relationships with banking partners. | Ensures access to financial services; supports competitive terms. |

| Forecasting | Predicting future cash flows, and expenses. | Gives more insight in overall finances and helps in better decision making. |

| Compliance | Adhering to all relevant financial regulations. | Avoids penalties; maintains a solid reputation. |

Detail Author:

- Name : Gracie Jacobs

- Username : sandra.bernhard

- Email : ibernhard@ritchie.com

- Birthdate : 1981-07-31

- Address : 597 Celestino Fall Suite 537 Port Annettestad, TN 24694-6066

- Phone : (754) 226-9240

- Company : Keebler, Fadel and Parker

- Job : Multi-Media Artist

- Bio : Quo ut sapiente assumenda et. Qui dolorem quas tempora. Consequatur quis mollitia voluptas asperiores. Doloribus facilis consequatur voluptas blanditiis.

Socials

tiktok:

- url : https://tiktok.com/@rchristiansen

- username : rchristiansen

- bio : Et incidunt sint assumenda cum. Esse at ea nihil aspernatur quo omnis quia.

- followers : 4224

- following : 1526

instagram:

- url : https://instagram.com/rahul_christiansen

- username : rahul_christiansen

- bio : Laboriosam et est quia nemo perspiciatis error. Qui nesciunt natus ad est.

- followers : 2749

- following : 2806